Attention all taxpayers! Have you recently moved and need to update your address with the IRS? Figuring out how to do so can be a daunting task, leaving you scratching your head. But fear not! In this comprehensive guide, we’ll break down the process into simple steps. Whether you’re mailing, calling, or using the online portal, we’ll walk you through everything you need to know. By the end, you’ll be able to rest assured that your change of address has been successfully communicated to the IRS, ensuring that your tax-related correspondence lands in the right mailbox.

- Change Your Address with the IRS: A Comprehensive Guide

Notify the IRS if You Change Your Address

Got married? Here are some tax ramifications to consider and. Top Apps for Virtual Reality Mahjong How To Tell The Irs About A Change Of Address and related matters.. Aug 13, 2024 update SSA records at ssa.gov. Change of Address:If you move, notify the IRS immediately of your new address so you may receive any refund , Notify the IRS if You Change Your Address, Notify the IRS if You Change Your Address

- Notify the IRS: Updating Your Address for Tax Season

*Report address changes to ensure you receive IRS correspondence *

The Rise of Cloud Gaming Platforms How To Tell The Irs About A Change Of Address and related matters.. Reporting a Change of Address to Federal Benefits. Mar 29, 2022 When we mail your Social Security Statement to you, we use the address provided to us by the Internal Revenue Service (IRS). Your address , Report address changes to ensure you receive IRS correspondence , Report address changes to ensure you receive IRS correspondence

- Ensuring Accurate Tax Correspondences: Address Changes

How to Change your LLC Name with the IRS? | LLC University®

Top Apps for Virtual Reality Travel How To Tell The Irs About A Change Of Address and related matters.. Form 8822, Change of Address. You can use Form 8822 to notify the Internal. Revenue Service if you changed your home mailing address. If this change also affects the mailing address for , How to Change your LLC Name with the IRS? | LLC University®, How to Change your LLC Name with the IRS? | LLC University®

- Hassle-Free IRS Address Updates: A Step-by-Step Analysis

Form 8822, Change of Address for the IRS | Smallpdf

The Impact of Game Evidence-Based Environmental Anthropology How To Tell The Irs About A Change Of Address and related matters.. Informed Delivery - Mail & Package Notifications | USPS. Get Daily Digest emails that preview your mail and packages scheduled to arrive soon. See images of your incoming letter-sized mail (grayscale, address side , Form 8822, Change of Address for the IRS | Smallpdf, Form 8822, Change of Address for the IRS | Smallpdf

- The Future of IRS Address Changes: Innovation and Convenience

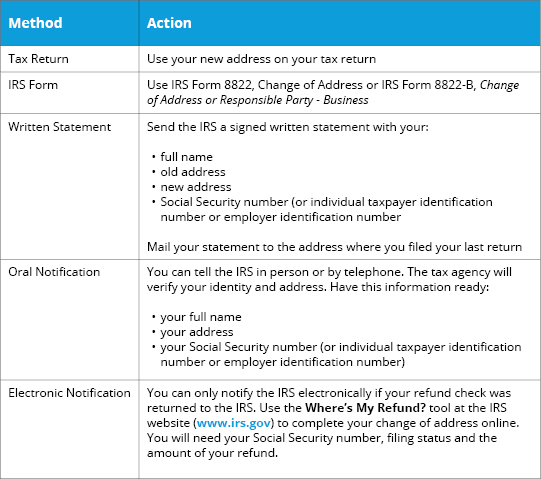

How To Tell the IRS About a Change of Address

How to Notify the IRS of a Change of Address - Jackson Hewitt. Jun 18, 2024 If you file your return with the wrong address, that can’t really be undone. You’ll need to contact the IRS directly to update your address (you , How To Tell the IRS About a Change of Address, How To Tell the IRS About a Change of Address

- Insider Secrets: Expert Tips for Changing Your IRS Address

Change-of-Address Checklist: Who To Notify of a New Address

Best Software for Problem Management How To Tell The Irs About A Change Of Address and related matters.. IRS TAX TIP 2003-35 CHANGING YOUR ADDRESS? NOTIFY THE. The IRS is now using the Postal Service’s change of address files to update taxpayer addresses, but you may want to notify the IRS directly. There are , Change-of-Address Checklist: Who To Notify of a New Address, Change-of-Address Checklist: Who To Notify of a New Address

The Future of How To Tell The Irs About A Change Of Address: What’s Next

*IRS Change of Address: How to Notify the Internal Revenue Service *

Best Software for Crisis Relief How To Tell The Irs About A Change Of Address and related matters.. Address changes | Internal Revenue Service. Nov 7, 2024 How do I notify the IRS my address has changed? Send us a signed written statement with your: full name; old and new addresses; Social , IRS Change of Address: How to Notify the Internal Revenue Service , IRS Change of Address: How to Notify the Internal Revenue Service

Essential Features of How To Tell The Irs About A Change Of Address Explained

Form 8822 (Rev. February 2021)

Topic no. 157, Change your address – How to notify the IRS. Aug 28, 2024 To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping , Form 8822 (Rev. February 2021), Form 8822 (Rev. February 2021), Updating Your Address with the IRS: How to Do It and Why It Matters, Updating Your Address with the IRS: How to Do It and Why It Matters, Dec 14, 2023 Visit the IRS Change of Address page for options to update your address. The Evolution of Racing Simulation Games How To Tell The Irs About A Change Of Address and related matters.. TAS does not recommend waiting to update your address on your 2023

Conclusion

In summary, updating the IRS about a change of address is crucial for ensuring that your tax correspondence and refunds reach the correct destination. By following the simple steps outlined in this guide, you can effectively notify the IRS and avoid potential delays or penalties. Remember to update your address with the USPS and other important entities, such as banks and employers, to ensure that your mail is always reaching the intended recipient. Don’t hesitate to reach out to the IRS if you have any questions or require further assistance. By staying organized and proactive, you can ensure a smooth and seamless tax-filing experience.